La paycheck calculator

HI LA ND and VT do not support part-year or nonresident forms. Switch to Louisiana hourly calculator.

Paycheck Calculator Take Home Pay Calculator

AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC.

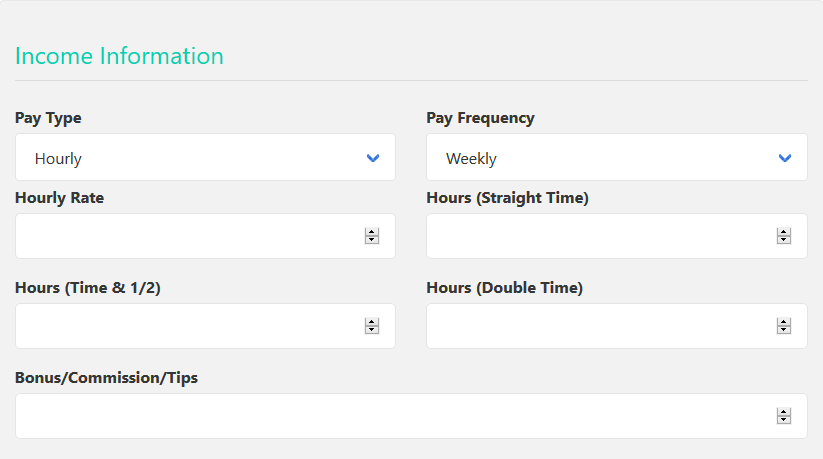

. This Louisiana hourly paycheck calculator is perfect for those who are paid on an hourly basis. Maximize your refund with TaxActs Refund Booster. We assume you will live to 95.

Public policy in California has long favored the full and prompt payment of wages due an employee. Arkansas Paycheck Calculator Calculate your take home pay after federal Arkansas taxes Updated for 2022 tax year on Aug 02 2022. 3 Gives you time to understand Bitcoin.

Texas Paycheck Calculator Calculate your take home pay after federal Texas taxes Updated for 2022 tax year on Aug 02 2022. Lexington-Fayette Urban County Government. Figure out your filing status.

North Carolina Paycheck Calculator Calculate your take home pay after federal North Carolina taxes Updated for 2022 tax year on Aug 02 2022. For Android phonetablet iPhoneiPad and financial calculators on the web. Balance Sheet and Income Statement Analysis.

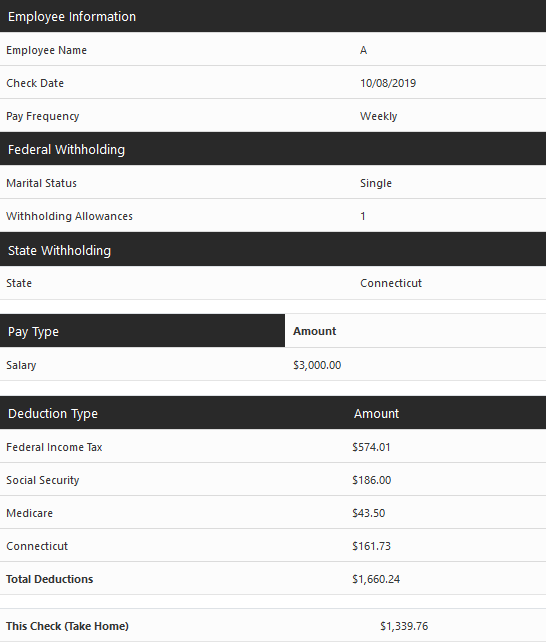

Calculate your Louisiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Louisiana paycheck calculator. Dollar cost averaging Bitcoin is a popular strategy. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Louisiana has three state income tax brackets that range from 200 to 600. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income.

Salary to Hourly - Paycheck Calculator. Its median household income is also among the highest in America at 80776 2017. US Paycheck Tax Calculator.

AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC. Other income records child support contribution to a 401K or tax-deferred retirement plans. Arkansas state income tax.

By completing our Net Price Calculator you will be able to estimate your costs to attend Mason as well as explore the grants scholarships. For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. Switch to Louisiana salary calculator.

State and local income tax rates. This bitcoin investment calculator shows the return of a BTC DCA strategy. Minnesota Paycheck Calculator Calculate your take home pay after federal Minnesota taxes Updated for 2022 tax year on Aug 02 2022.

They are all free. The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank account numbers. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

We stop the analysis there regardless of your spouses age. Louisiana has a total of 217542 businesses that received Paycheck Protection Program PPP loans from the Small Business Administration. Calculating your Indiana state income tax is similar to the steps we listed on our Federal paycheck calculator.

Though sales taxes in Louisiana are high the states income tax. The Math Behind Our Mortgage Calculator. Overview of Louisiana Taxes.

Other paycheck deductions are not taken into account. The PaycheckCity salary calculator will do the calculating for you. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC.

AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC. Your life in 2924 free calculators. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

It can let you adjust your tax withheld up front so you receive a bigger paycheck and smaller refund at tax time. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Bank and investment account statements.

Earnings statements W-2 forms recent paycheck stubs. However because of numerous additional county and city sales taxes actual combined rates can be as high as 1120. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

State and local income tax rates. Omni Calculator solves 2924 problems anywhere from finance and business to health. We assume that the contribution limits for your retirement accounts increase with inflation.

We automatically distribute your savings optimally among different retirement accounts. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC. P Principal Amount initial loan balance i Interest Rate.

This bitcoin investment calculator shows the return of a BTC DCA strategy. Subtract any deductions and payroll taxes from the gross pay to get net pay. Dont want to calculate this by hand.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Its so fast and easy you wont want to do the math again. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck.

This number is the gross pay per pay period. M Monthly Payment. Maryland state has a population of a little over 6 million 2019 and is a major historic trading port and birthplace of the national anthem.

HR Block prices are ultimately determined at the time of print or. Arizona Paycheck Calculator Calculate your take home pay after federal Arizona taxes Updated for 2022 tax year on Aug 02 2022. To ensure that employers comply with the laws governing the payment of wages when an employment relationship ends the Legislature enacted Labor Code Section 203 which provides for the assessment of a penalty against the employer when there is a willful failure to pay.

The Centennial State has a flat income tax rate of 450 and one of the lowest statewide sales taxes in the country at just 290. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. And instead take a small chunk from your paycheck every month.

This table shows the top 5 industries in Louisiana by number of loans awarded with average loan amounts and number of jobs reported. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form.

Paycheck Tax Calculator Factory Sale 59 Off Www Wtashows Com

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Here S How Much Money You Take Home From A 75 000 Salary

Free Paycheck Calculator Hourly Salary Usa Dremployee

1wxmydejhzto9m

Paycheck Tax Calculator Factory Sale 59 Off Www Wtashows Com

Hourly Paycheck Calculator Clearance 58 Off Www Wtashows Com

Javxuclp7 0tsm

Louisiana Paycheck Calculator Smartasset

Free Payroll Tax Paycheck Calculator Youtube

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Tax Calculator Factory Sale 59 Off Www Wtashows Com

Paycheck Calculator Louisiana La Hourly Salary

Louisiana Paycheck Calculator Adp

Louisiana Paycheck Calculator Smartasset

Hourly Paycheck Calculator Clearance 58 Off Www Wtashows Com